Best Debt Consolidation Loans for Bad Credit: 2024 Rates Updated for 2026

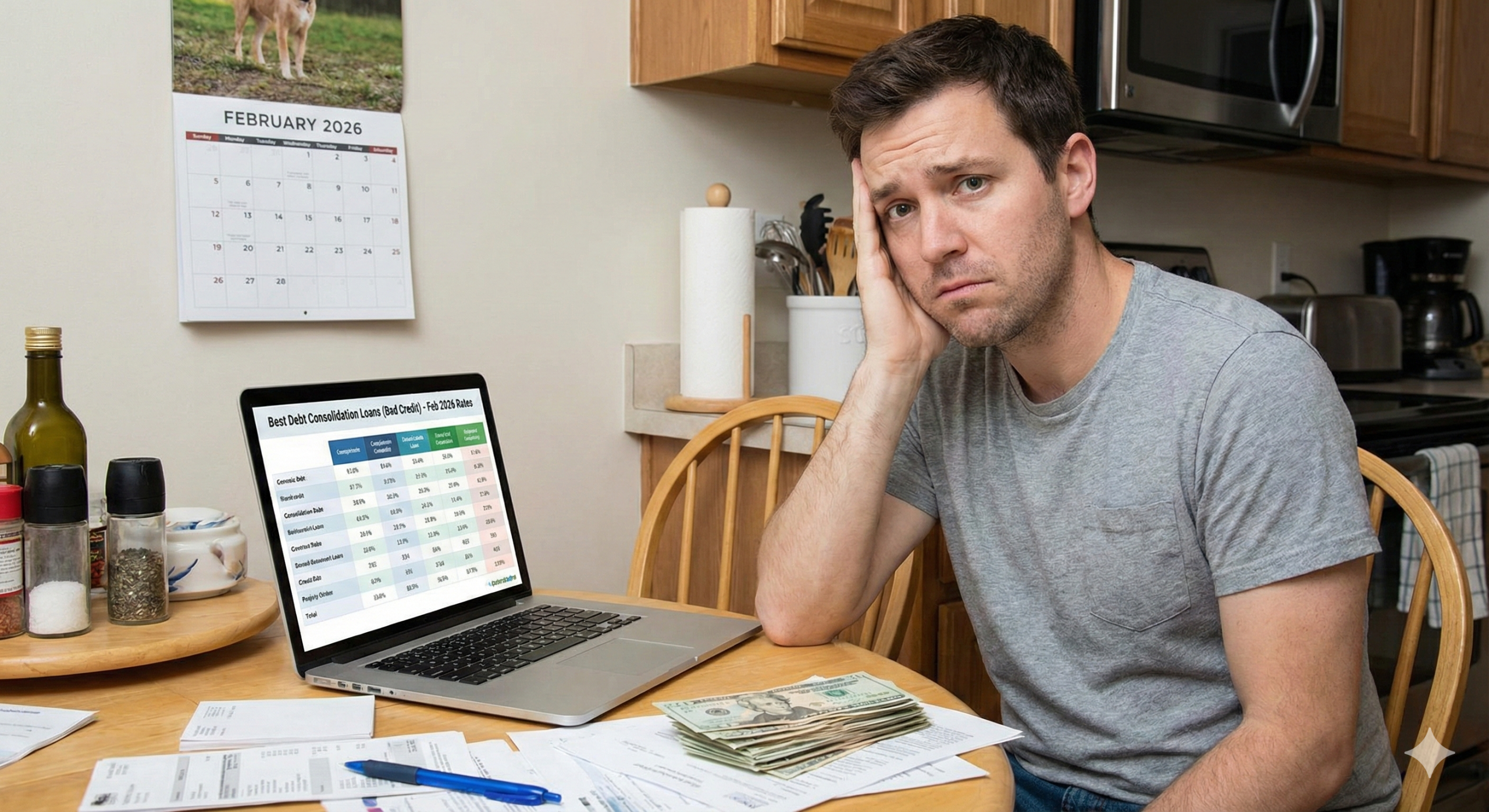

Feeling crushed by multiple credit card payments and a less-than-perfect credit score? What if there was a simpler way to manage it all? Exploring debt consolidation loans for bad credit could reveal a path to financial clarity you didn’t think was possible, starting today.

When you’re juggling high-interest credit card bills, medical expenses, and other unsecured debts, the pressure can feel immense. The idea of combining all these obligations into a single, more manageable monthly payment is the core concept of debt consolidation. Instead of tracking multiple due dates and interest rates, you could have just one. Have you ever wondered how much simpler your budget could be with this approach? For many, it’s not just about simplifying payments; it’s about finding a structured way to tackle debt, especially when a low credit score seems to close other doors. This strategy could be the key to regaining control and reducing financial stress.

Understanding Your Options When Credit is a Challenge

A bad credit score can often feel like a roadblock, making you believe that financial help is out of reach. It’s easy to get discouraged when it seems like every door is closed. But what if that wasn’t the entire story? The financial landscape is constantly evolving, and solutions are emerging specifically for individuals in this exact situation. The concept of bad credit debt consolidation exists because lenders understand that a credit score is just one part of a person’s financial picture. They may look at other factors, like income and employment stability, to assess eligibility. It’s about shifting the focus from past financial mistakes to your current ability to manage a single, structured loan payment. The key is knowing where to look and what questions to ask.

So, how does this process actually work to your advantage? By securing a single loan to pay off your various creditors, you effectively replace multiple high-interest debts with one loan, potentially at a more favorable interest rate. This isn’t a guarantee, but it’s the primary goal. The immediate benefit is streamlining your finances down to one payment, which makes budgeting significantly easier and reduces the risk of missing a payment. Have you considered what it would take to get approved? Understanding the steps involved is crucial. Discover more about How to Qualify for Bad Credit Consolidation Today and see what criteria lenders are really looking for in applicants. This knowledge can empower you to take the next step with confidence.

What Could a Single Monthly Payment Mean for You?

Imagine your financial life with less chaos. No more logging into multiple credit card portals, no more deciphering confusing statements, and no more anxiety about which bill is due next. This is the peace of mind that a single monthly payment can offer. Consolidating your debt is more than just a financial transaction; it’s a strategic move to reduce mental clutter and stress. This newfound simplicity can free up mental energy, allowing you to focus on your long-term financial goals rather than just surviving the month. There are various types of debt relief loans available, each with its own structure. Have you ever explored the difference between secured and unsecured options and which might be better suited for your circumstances?

Finding the right partner for this journey is as important as the decision to consolidate itself. With so many companies offering solutions, how can you tell which ones are reputable and have your best interests at heart? It’s essential to look for transparency in fees, clear communication, and a history of positive customer experiences. You should feel supported, not pressured. Researching different providers and understanding their terms is a non-negotiable step. Are you curious about who the leading providers are in your area? Finding trusted experts can make all the difference. Learn more about the Top Rated Debt Consolidation Companies Near Me to start your search on the right foot.

Did You Know?

Consolidating your credit card debt into a single loan doesn’t just simplify your payments. It can also change your credit utilization ratio, which is a significant factor in calculating your credit score. As you pay off your credit cards with the loan, your available credit increases, which could potentially have a positive impact over time. It’s a financial strategy with multiple potential benefits worth exploring.

Navigating the Path to Financial Clarity

Embarking on the path to manage your debt is a proactive step toward financial wellness. The process of seeking out debt consolidation loans for bad credit is not just about securing funds; it’s about creating a new, more sustainable financial plan. What would it feel like to have a clear end date for your debt? A consolidation loan provides a fixed repayment term, so you know exactly when you will be debt-free if you stick to the plan. This structured approach contrasts sharply with the revolving nature of credit card debt, where it can feel like you’re running in place. Preparing for this journey involves gathering your financial documents, understanding your total debt amount, and being honest about your budget. It’s about setting yourself up for success from the very beginning.

Ultimately, the power to change your financial situation lies in your hands. Exploring your options is the first, and often most difficult, step. Information is your greatest asset. By learning about how the best debt consolidation loans work, you can make an informed decision instead of a reactive one. You don’t have to have all the answers right now. The goal is to simply open the door to possibilities and see what might be available to you. What if a solution that aligns with your income and goals is waiting for you? Taking the time to investigate and compare potential debt consolidation loans for bad credit could be the most important financial decision you make this year, paving the way for a brighter, less stressful future.